How to record PPP loan forgiveness in QuickBooks?

Learn to navigate PPP loan forgiveness with QuickBooks: Basics, preparation, expense recording, tracking, reconciliation, and reporting for smooth process.

Introduction to PPP Loan Forgiveness

Navigating the world of PPP loan forgiveness can be a daunting task for small business owners, but fear not – QuickBooks is here to streamline the process! As you aim to maximize your loan forgiveness, understanding how to record these crucial transactions in QuickBooks is key. Let’s dive into the steps and tips on efficiently manage or record PPP loan forgiveness in QuickBooks.

Understanding the Basics of QuickBooks

QuickBooks is a powerful accounting software that helps businesses manage their finances efficiently. It allows you to track income and expenses, create invoices, and generate reports to make informed financial decisions.

Understanding the basics of QuickBooks involves familiarizing yourself with its interface and key features. You can customize your chart of accounts, set up bank feeds for seamless transaction tracking, and categorize transactions accurately.

One essential aspect is setting up your company profile correctly by inputting accurate information such as business name, address, and tax details. This ensures that your financial records are organized and compliant with regulations.

QuickBooks offers various versions tailored to different business needs, from self-employed individuals to large enterprises. Exploring these options can help you choose the right fit for your organization's size and complexity.

Mastering the fundamentals of QuickBooks is crucial for streamlining your accounting processes and maximizing efficiency in managing PPP loan forgiveness.

Preparing for PPP Loan Forgiveness in QuickBooks

When it comes to preparing for PPP loan forgiveness in QuickBooks, organization is key. Start by ensuring all your financial data is up to date within the software. This includes verifying that expenses and payroll costs are accurately recorded.

Next, familiarize yourself with the specific requirements for PPP loan forgiveness outlined by the Small Business Administration (SBA). Understanding these guidelines will help you ensure that your records align with what is needed for loan forgiveness.

Consider setting up separate accounts or categories in QuickBooks to track expenses related specifically to the PPP loan. This level of detail can make it easier when it comes time to provide documentation for forgiveness.

As you prepare, keep communication open with your accountant or financial advisor. They can offer guidance on how best to classify expenses and navigate any potential complexities that may arise during the forgiveness process.

By taking proactive steps and staying organized within QuickBooks, you'll be better positioned to streamline the PPP loan forgiveness process when the time comes.

Recording Expenses and Payroll Costs in QuickBooks

When it comes to recording expenses and payroll costs for PPP loan forgiveness in QuickBooks, accuracy is key. Start by categorizing your expenses correctly within the software. This ensures that you can easily track and report on these expenses later.

For payroll costs, make sure to include wages, benefits, and taxes paid during the covered period. QuickBooks allows you to input this information efficiently so that you have a clear overview of your eligibility for forgiveness.

It's essential to keep detailed records of each expense incurred with supporting documentation. By maintaining organized records in QuickBooks, you streamline the process of applying for loan forgiveness when the time comes.

Utilize features like tags or labels within QuickBooks to easily identify which expenses are eligible for forgiveness under PPP guidelines. This will simplify the reconciliation process down the line.

By diligently recording your expenses and payroll costs in QuickBooks, you set yourself up for a smoother experience when seeking loan forgiveness – helping your business navigate these uncertain times with confidence.

Tracking Non-Payroll Expenses for Forgiveness

When it comes to tracking non-payroll expenses for PPP loan forgiveness in QuickBooks, attention to detail is key. These expenses include rent, utilities, mortgage interest, and other eligible costs that can be forgiven under the program.

To accurately track these non-payroll expenses, create separate accounts or categories within your QuickBooks system. This will help you easily differentiate between payroll and non-payroll costs when it's time to apply for forgiveness.

Make sure to regularly update and categorize these expenses in QuickBooks as they occur. Keeping meticulous records will streamline the forgiveness process and ensure you have all necessary documentation on hand.

Utilize QuickBooks reporting features to generate detailed reports showcasing your non-payroll expenses. This will not only help with forgiveness applications but also provide insights into your overall financial health during this period.

By diligently tracking and categorizing non-payroll expenses in QuickBooks, you'll be well-prepared when the time comes to seek PPP loan forgiveness.

Reconciliation and Reporting for PPP Loan Forgiveness

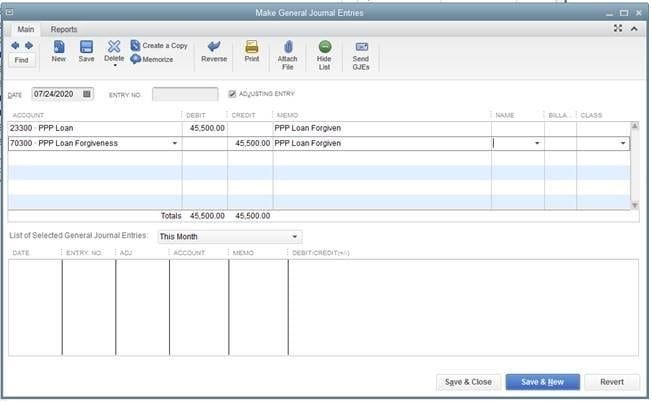

Once you have recorded all your expenses and payroll costs for PPP loan forgiveness in QuickBooks, it's crucial to reconcile and report the data accurately. Reconciliation involves ensuring that the information entered matches your bank statements and supporting documents. Double-checking these details can help prevent any discrepancies or errors in your reporting.

Reporting for PPP loan forgiveness requires generating specific reports within QuickBooks that showcase how the funds were utilized according to program guidelines. These reports should clearly outline both payroll and non-payroll expenses incurred during the covered period.

It is essential to keep detailed records of all transactions related to your PPP loan, including receipts, invoices, and other supporting documentation. This documentation will be invaluable when it comes time to apply for forgiveness or if there are any audits in the future.

By staying organized and thorough in your reconciliation and reporting processes, you can streamline the PPP loan forgiveness application process and ensure compliance with regulations set forth by both QuickBooks and governing bodies overseeing the program.

Conclusion:

Streamlining the process of recording PPP loan forgiveness in QuickBooks is essential for businesses seeking to maximize their benefits from the program. By understanding the basics of QuickBooks, preparing ahead for loan forgiveness, diligently recording expenses and payroll costs, tracking non-payroll expenses accurately, and performing reconciliation and reporting tasks efficiently within the software, businesses can navigate the complexities of PPP loan forgiveness seamlessly.

Utilizing QuickBooks effectively not only ensures compliance with forgiveness requirements but also simplifies the overall process by providing a centralized platform for managing all relevant financial data. With precise record-keeping and thorough documentation in place, businesses can confidently apply for full or partial forgiveness without unnecessary complications.

By leveraging the capabilities of QuickBooks and following best practices outlined in this article, businesses can streamline their PPP loan forgiveness journey and stay on top of their financial obligations during these challenging times. Here's to successfully navigating through PPP loan forgiveness with ease using QuickBooks as your trusted ally!

What's Your Reaction?

![Wireless Connectivity Software Market Size, Share | Statistics [2032]](https://handyclassified.com/uploads/images/202404/image_100x75_661f3be896033.jpg)