India Buy Now Pay Later Services Market Segmentation, Industry Analysis by Production, Consumption, Revenue And Growth Rate By 2032

India Buy Now Pay Later Services Market Research Report Information By Channel (Online and POS), By Enterprise (Large Enterprise and Small & medium enterprise), By End-user (Consumer Electronics, Fashion & Garments, Healthcare, Leisure & Entertainment

India Buy Now Pay Later Services Market Overview

The India Buy Now Pay Later (BNPL) services market has been experiencing significant growth, driven by factors such as the expansion of e-commerce, the availability of alternative payment options, and the increasing demand for convenient budgeting tools. The market is segmented by channel (online and POS), enterprise (large enterprise and small & medium enterprise), and end-user (consumer electronics, fashion & garments, healthcare, leisure and entertainment, retail, and others).

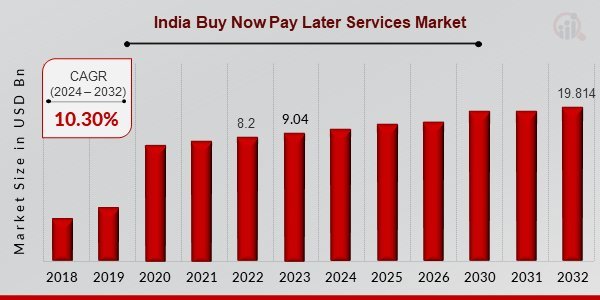

Market Size and Forecast

The buy now pay later services market industry is projected to grow from USD 9.04 Billion in 2023 to USD 19.814 Billion by 2032, reflecting the increasing demand for BNPL services among Millennials and Generation Z customers.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/21686

Market Trends and Analysis

The growth of e-commerce has significantly expanded the customer base for BNPL services, with online shoppers increasingly opting for BNPL options at the checkout due to the convenience it offers. The trend of BNPL is becoming popular across the region, enabling customers to access credit and defer payments, further fueled by the growing mobile internet penetration in the region. Additionally, the proliferation of retailers selling their products online has heightened the demand for BNPL services, particularly in the fashion & apparel segment.

Regional Analysis and Investment Opportunities

The widespread availability of smartphones and internet connectivity in countries like India has further fueled the adoption of BNPL services, making it a popular payment method for online shopping. The market share by age group and income level provides insights into the spending patterns and potential investment opportunities within the BNPL market.

Competitive Analysis and Key Players

- epayLater

- Zest Money BNPL

- Mobikwik ZIP

- Flipkart pay later

- Olamoney Postpaid

- Simpl

- Free charge

- Lazy Pay

- Flexmoney

- Amazon Pay later

- Money Tap

- Paytm postpaid

- Capital float

- Slice

The India BNPL services market is witnessing the involvement of various players, including fintech firms finalizing new investment rounds from existing shareholders and third-party companies handling back-office functions for retailers. The market is also attracting interest from investors and stakeholders, indicating a competitive landscape with potential for further growth and innovation.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/21686

In conclusion, the India Buy Now Pay Later Services Market is experiencing significant growth driven by the expansion of e-commerce, increasing demand for convenient budgeting tools, and the proliferation of retailers selling products online. The market is poised for substantial expansion, with a positive outlook for the industry and potential investment opportunities.

What's Your Reaction?

![Wireless Connectivity Software Market Size, Share | Statistics [2032]](https://handyclassified.com/uploads/images/202404/image_100x75_661f3be896033.jpg)