Maize Prices, Chart, Index, News & Forecast 2024

In Q4 2023, maize in South Korea was 325 USD/MT. The report outlines recent developments, updates, and trend in the global corn market, giving stakeholders timely information.

Maize Price in South Korea

- South Korea: 325 USD/MT

Maize Prices December 2023:

- South Korea: 325 USD/MT

- Europe: 235 USD/MT

- Brazil: 240 USD/MT

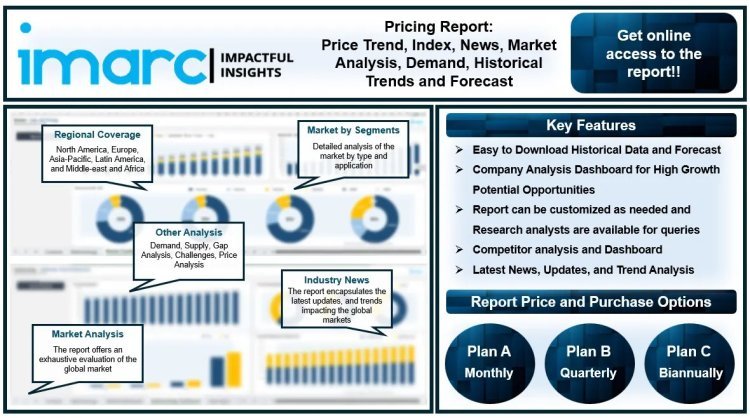

Report Offering:

- Monthly Updates - Annual Subscription

- Quarterly Updates - Annual Subscription

- Biannually Updates - Annual Subscription

The study delves into the factors affecting Maize price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/maize-pricing-report/requestsample

Maize Price Trend- Q4 2023

The maize market is primarily driven by population growth and urbanization has augmented food demand, especially in regions where maize is a dietary staple, leading to higher production needs. Diverse applications, including food, animal feed, industrial processing, and biofuel production, create multiple demand streams, enhancing market stability. Growing livestock and poultry sectors, particularly in emerging economies, fuel demand for maize as a primary feed ingredient, amplifying market dynamics. Climate variability, government policies, technological advancements, and evolving consumer preferences further impact maize production, consumption, trade flows, and market competitiveness, highlighting the complexity of its market drivers.

Maize Market Analysis

The global maize market size reached 1.26 Billion tonnes in 2023. By 2032, IMARC Group expects the market to reach 1.63 Billion tonnes, at a projected CAGR of 2.90% during 2023-2032. After a significant price decline at the beginning of the fourth quarter in December 2023, the maize market showed promise and settled at US dollar 212 per metric ton. Initially, October witnesseda persistent fall in maize prices, which was impacted by a negative demand forecast from the previous month. The worldwide maize market remained competitive even though demand improved due to several variables, including lower export expectations and greater global output predictions. Additionally, there was fierce competition amongst major exporters, and as a result, prices dropped as companies undercut one another's offers. In the fourth quarter of 2023, the APAC maize (corn) market faced challenges due to divergent patterns in both importing and exporting countries. The market encountered hurdles due to several variables, including economic instability, demand fluctuations, and a decline in local spot market prices.

Throughout the quarter, prices remained largely negative, especially in China. Following the National Day vacation in October 2023, Northeast China saw a steady increase in corn volume, which helped to build relationships with both new and established markets. However, the cattle industry saw a significant downturn, and some areas were seeing a recurrence of African swine flu. Moreover, in both exporting and importing countries in the European zone, the prices of maize, or corn, started the fourth quarter on a negative note but ended on an increasing trend. Initially, Grateful to the harvesting of the new crop, there was an abundant supply of corn in the region throughout October, especially in Ukraine, a major exporter of maize. Prices decreased due to the sellers' increased competitiveness brought on by this spike in availability. Furthermore, the South American market for maize (corn) saw a steady increase in price starting in the fourth quarter of 2023 and continued until the last few weeks of December 2023. Drought conditions in various parts of Brazil and Argentina began to affect crops in October 2023, which caused a spike in corn prices.

Key Points Covered in the Maize Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Maize Prices

- Maize Price Trend

- Maize Demand & Supply

- Maize Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Maize Price Analysis

- Maize Industry Drivers, Restraints, and Opportunities

- Maize News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand.

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece.

- North America: United States and Canada.

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru.

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco.

Browse More Pricing Reports by IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

![Wireless Connectivity Software Market Size, Share | Statistics [2032]](https://handyclassified.com/uploads/images/202404/image_100x75_661f3be896033.jpg)