The Ecosystem of Real Estate Investment Trust Market

The global REIT market has seen remarkable growth over the past decade. The total market capitalization of REITs globally stood at approximately $1.7 trillion at the end of 2022, reflecting a compounded annual growth rate (CAGR) of around 9% over the last five years. This growth is driven by several factors, including increased investor awareness, the quest for yield in a low-interest-rate environment, and the growing inclusion of REITs in major financial indices.

Read this- The Global Mobile Phone Accessories Market with Future Trends

The REIT Ecosystem in India

India's REIT market, though nascent compared to its global counterparts, is poised for significant growth. The Indian REIT ecosystem has been shaped by a combination of regulatory reforms, economic growth, and increasing urbanization.

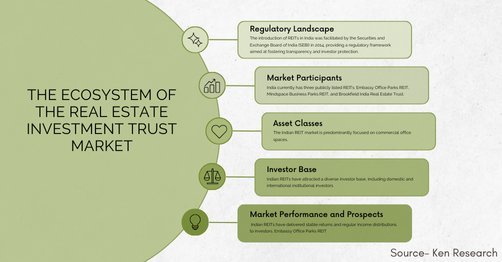

Regulatory Landscape

The introduction of REITs in India was facilitated by the Securities and Exchange Board of India (SEBI) in 2014, providing a regulatory framework aimed at fostering transparency and investor protection. Since then, several amendments have been made to streamline the process and make REITs more attractive to both sponsors and investors. Notable amendments include the reduction in the minimum asset size for REITs, the allowance for more diverse asset classes, and the relaxation of leverage norms.

Market Participants

India currently has three publicly listed REITs: Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust. These REITs have collectively raised over INR 25,000 crore (approximately $3.3 billion) since their inception. The success of these initial offerings has set a precedent for other real estate developers and investors, sparking interest in the creation of more REITs.

Asset Classes

The Indian REIT market is predominantly focused on commercial office spaces. Embassy Office Parks REIT, for example, owns and operates a portfolio of office parks and buildings totaling over 33 million square feet. Mindspace Business Parks REIT and Brookfield India Real Estate Trust also primarily invest in Grade A office spaces across major urban centers.

The potential for diversification is vast, with emerging interest in retail, industrial, and hospitality REITs. The warehousing and logistics sector, in particular, is expected to see significant REIT activity, driven by the boom in e-commerce and the implementation of the Goods and Services Tax (GST), which has streamlined interstate logistics.

Also Read- The Top Player Analysis of Brass Industry

Investor Base

Indian REITs have attracted a diverse investor base, including domestic and international institutional investors, high-net-worth individuals, and retail investors. The inclusion of REITs in major stock indices and the provision of tax benefits have further enhanced their appeal. For retail investors, REITs offer a unique opportunity to invest in high-quality real estate assets with relatively lower capital requirements and the benefit of regular income distributions.

Market Performance and Prospects

Since their inception, Indian REITs have delivered stable returns and regular income distributions to investors. Embassy Office Parks REIT, for instance, has consistently distributed dividends, reflecting the steady rental income from its high-occupancy office properties. The overall performance of Indian REITs has been resilient, even amid economic uncertainties brought about by the COVID-19 pandemic.

The future prospects of the Indian REIT market are promising. The continued economic growth, urbanization, and government initiatives such as the Smart Cities Mission and infrastructure development are expected to drive demand for commercial real estate. Additionally, the increasing awareness and acceptance of REITs as a viable investment option will likely attract more sponsors and investors, leading to the launch of new REITs and the diversification of asset classes.

Conclusion

The global REIT market is on a steady growth trajectory, with increasing investor participation and diversification across regions and asset classes. While the U.S. remains the dominant player, emerging markets like India are showing significant potential. The Indian REIT ecosystem, though still in its early stages, is supported by a conducive regulatory framework, strong market fundamentals, and growing investor interest.

What's Your Reaction?

![Wireless Connectivity Software Market Size, Share | Statistics [2032]](https://handyclassified.com/uploads/images/202404/image_100x75_661f3be896033.jpg)