The Evolution of Investment Banking in India

Investment banking in India is experiencing a period of robust growth, driven by a burgeoning economy, increased market activity, and the country's expanding corporate sector. The investment banking industry in India was estimated to be worth approximately $1.8 billion by 2023. This sector has witnessed a compound annual growth rate (CAGR) of around 12% over the past five years.

The primary drivers for this growth include a surge in mergers and acquisitions (M&A), initial public offerings (IPOs), and private equity investments.

The investment banking landscape in India is evolving rapidly with increasing demand for sophisticated financial services. Companies are seeking advisory services for capital raising, restructuring, and navigating the complexities of the regulatory environment. This has led to a significant uptick in the activities of investment banks in India, which are now playing a crucial role in facilitating these transactions.

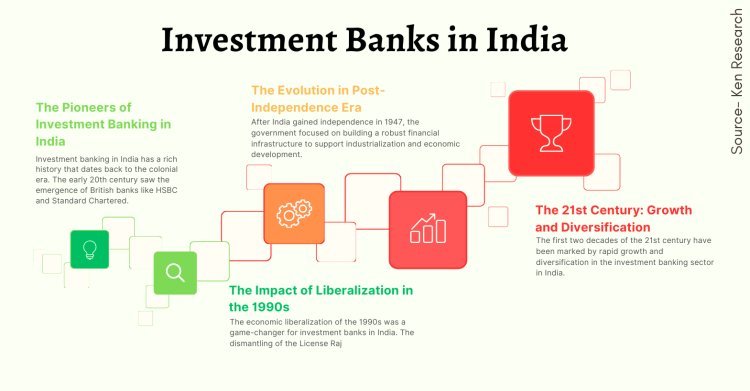

Investment Banks in India

The Pioneers of Investment Banking in India

Investment banking in India has a rich history that dates back to the colonial era. The early 20th century saw the emergence of British banks like HSBC and Standard Chartered, which played a significant role in the Indian financial markets. These banks laid the foundation for modern investment banking in India by providing essential services like foreign exchange, trade finance, and merchant banking.

The Evolution in Post-Independence Era

After India gained independence in 1947, the government focused on building a robust financial infrastructure to support industrialization and economic development. The 1950s and 1960s witnessed the establishment of several public sector banks and financial institutions. One of the landmark developments during this period was the creation of the Industrial Credit and Investment Corporation of India (ICICI) in 1955. ICICI, which later became ICICI Bank, was instrumental in promoting industrial growth through project financing and investment banking services.

In the 1980s, the Indian government initiated a series of financial sector reforms aimed at liberalizing the economy. These reforms paved the way for the entry of private sector banks and international financial institutions. During this period, several prominent Indian banks like HDFC Bank, Kotak Mahindra Bank, and Axis Bank entered the investment banking space, offering a wide range of services including M&A advisory, capital markets, and structured finance.

The Impact of Liberalization in the 1990s

The economic liberalization of the 1990s was a game-changer for investment banks in India. The dismantling of the License Raj, along with the opening up of the economy to foreign investment, created a conducive environment for investment banking activities. The 1990s saw a surge in IPOs and M&A deals, with investment banks playing a pivotal role in these transactions. This period also witnessed the entry of global investment banking giants like Goldman Sachs, Morgan Stanley, and JP Morgan into the Indian market. These firms brought with them advanced financial products, global best practices, and a wealth of experience, which significantly enhanced the capabilities of investment banking companies in India.

The 21st Century: Growth and Diversification

The first two decades of the 21st century have been marked by rapid growth and diversification in the investment banking sector in India. The market has become more sophisticated, with investment banks offering a wide array of services including private equity advisory, debt syndication, and wealth management. The rise of technology and digital platforms has also transformed the way investment banks operate, making transactions more efficient and transparent.

Today, India boasts a vibrant investment banking ecosystem with a mix of domestic and international players. Leading investment banking companies in India include ICICI Bank, HDFC Bank, Kotak Mahindra Bank, Axis Bank, and SBI Capital Markets. These banks have built strong reputations for their expertise in deal-making, advisory services, and innovative financial solutions. Additionally, global giants like Goldman Sachs, Morgan Stanley, and JP Morgan continue to have a significant presence in the Indian market, catering to the needs of multinational corporations and large domestic enterprises.

Conclusion

The investment banks in India have come a long way from their humble beginnings during the colonial era to becoming a dynamic and integral part of the country's financial system. With a market size of approximately $1.8 billion and a healthy growth rate of 12% CAGR, the sector is poised for continued expansion. The history of investment banks in India reflects a journey of adaptation and growth, driven by economic reforms, technological advancements, and increasing demand for sophisticated financial services.

What's Your Reaction?

![Wireless Connectivity Software Market Size, Share | Statistics [2032]](https://handyclassified.com/uploads/images/202404/image_100x75_661f3be896033.jpg)